In today’s trading world, proprietary trading firms (prop firms) have become a popular way for traders to access significant capital without investing their own money. But with so many options available, it’s crucial to find the right partner. In this article, we’ll walk you through how to choose a reliable prop firm and how the website Prop Firm Match can help you make the best choice.

What is a Prop Firm?

A prop firm is a company that provides traders with access to its capital for the purpose of making profitable trades. If a trader passes the evaluation (usually through a demo challenge), they receive funded accounts, and profits are split between the trader and the company.

Key Criteria for Choosing a Prop Firm

When selecting a prop firm, consider the following factors:

- Company reputation

- Challenge/evaluation difficulty

- Funding amount

- Profit split model

- Trading rules (max drawdown, risk limits, banned strategies)

- Payout speed

- Available trading platforms (MT4, MT5, cTrader, etc.)

Manually researching each firm can be time-consuming. That’s where PropFirmMatch comes in handy.

How PropFirmMatch Helps You Find the Right Prop Firm

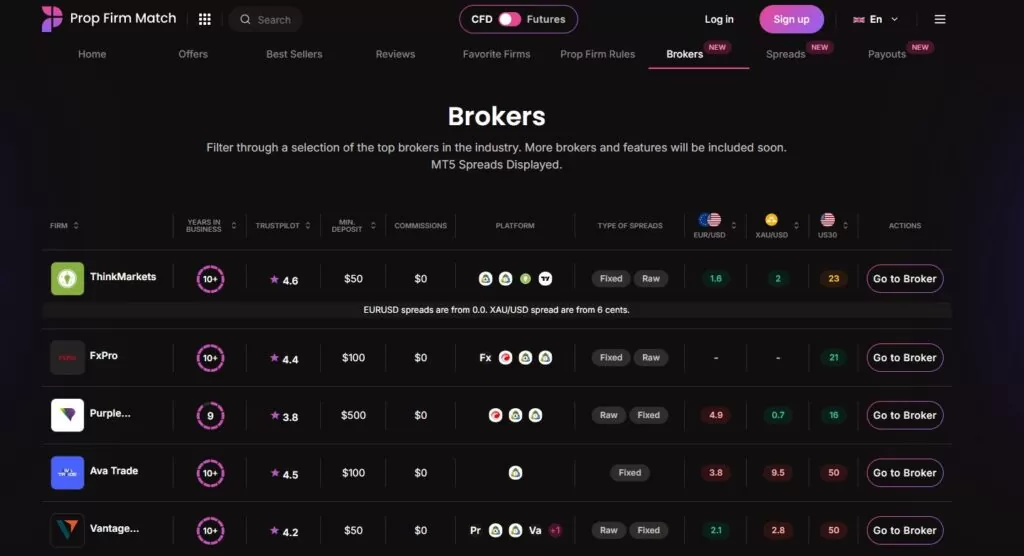

PropFirmMatch.com is a platform that lets you quickly compare dozens of prop firms based on various criteria. Think of it as a “search engine” for finding the best-funded trading programs.

Main features of PropFirmMatch:

- 🔍 Smart Filters: Filter firms by funding size, platform, payout percentage, challenge type, and more.

- 📊 Comparison Tables: Easy-to-read visual tables showing key firm details.

- 🧠 AI-Powered Suggestions: Get smart recommendations tailored to your needs.

- 💬 Trader Reviews: See real user experiences and feedback.

Example: How to Use PropFirmMatch

Let’s say you’re looking for a firm that offers:

- $100,000 in funding

- Simple rules

- 80–90% profit split

- MT5 trading platform

Here’s how to find it:

- Visit PropFirmMatch.com

- Apply the relevant filters

- Instantly view a list of matching prop firms (e.g., MyForexFunds, FTMO, The5ers)

- Read trader reviews, compare terms, and make an informed decision

Tips for Choosing a Prop Firm

- Don’t just chase the biggest funding — look for consistent, fair conditions

- Read the rules carefully, especially drawdown and strategy restrictions

- Check real payout history via reviews or communities

- Start with smaller capital, test the firm before scaling up

Choosing the right prop firm is the first step toward professional trading with access to large capital. Instead of wasting hours comparing companies manually, use the proven tool — PropFirmMatch. This website helps you find the perfect match quickly, easily, and safely.

👉 Try it now: propfirmmatch.com