In the world of trading, consistent profitability is not just about having the right strategies—it’s about discipline, reflection, and continuous improvement. One of the most powerful yet underrated tools that help traders make money is a trading journal. Whether you’re a day trader, swing trader, or long-term investor, maintaining a trading journal can be the key to unlocking long-term success in the markets.

What Is a Trading Journal?

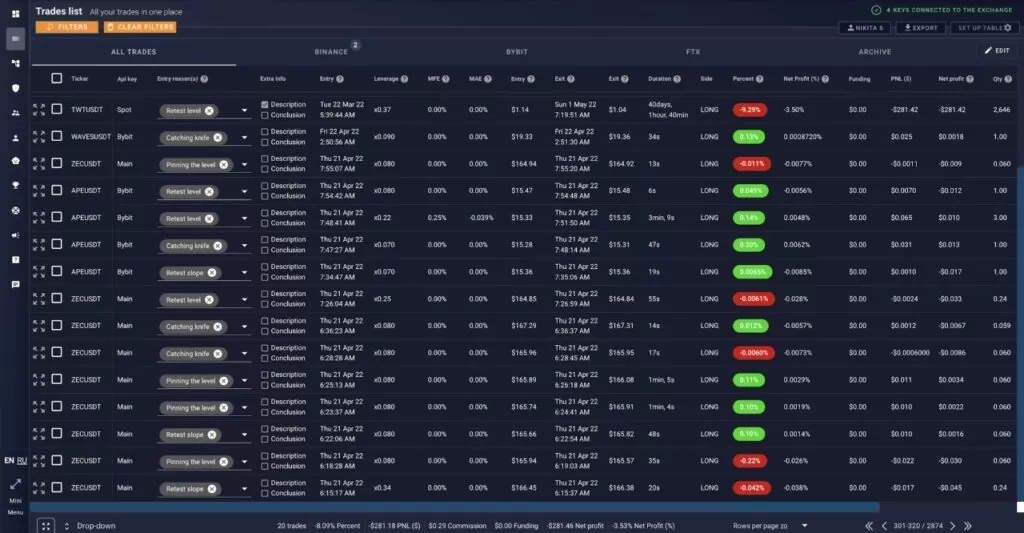

A trading journal is a detailed record of all your trades, including entries, exits, position sizes, strategies used, emotional states, and outcomes. It’s more than just a spreadsheet; it’s a personal log that helps you understand what works and what doesn’t.

A well-maintained journal should include:

- Date and time of trade

- Asset traded

- Entry and exit points

- Position size

- Profit or loss

- Reason for entering the trade

- Emotional state during the trade

- Lessons learned

Why Traders Make More Money with a Journal

- Identifying Patterns and Mistakes A trading journal allows you to spot recurring mistakes that may be costing you money. For example, if you notice that your losses often come after emotional trades, you can focus on improving emotional control.

- Improving Discipline Writing down your trading decisions forces you to think logically. This discourages impulsive trades and encourages you to follow your trading plan more strictly.

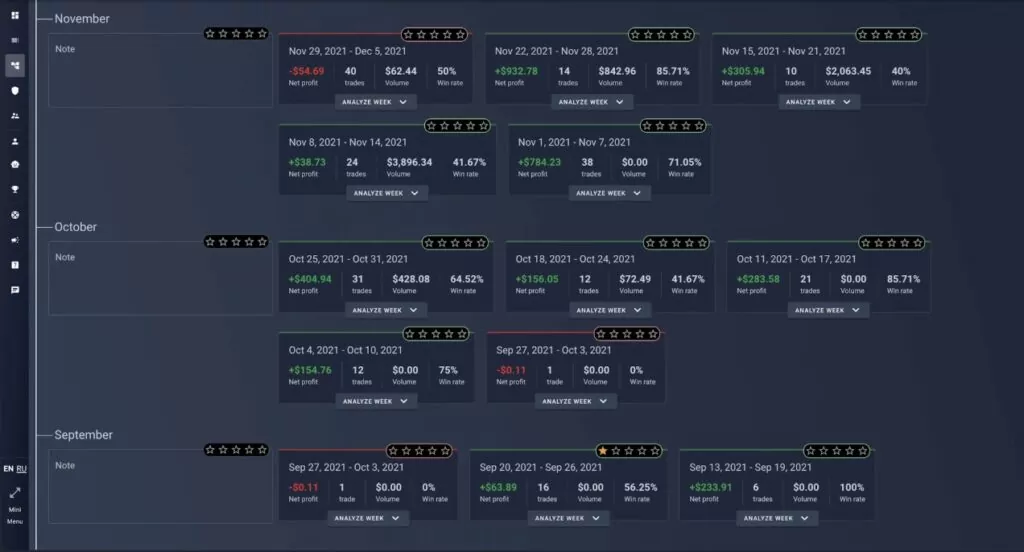

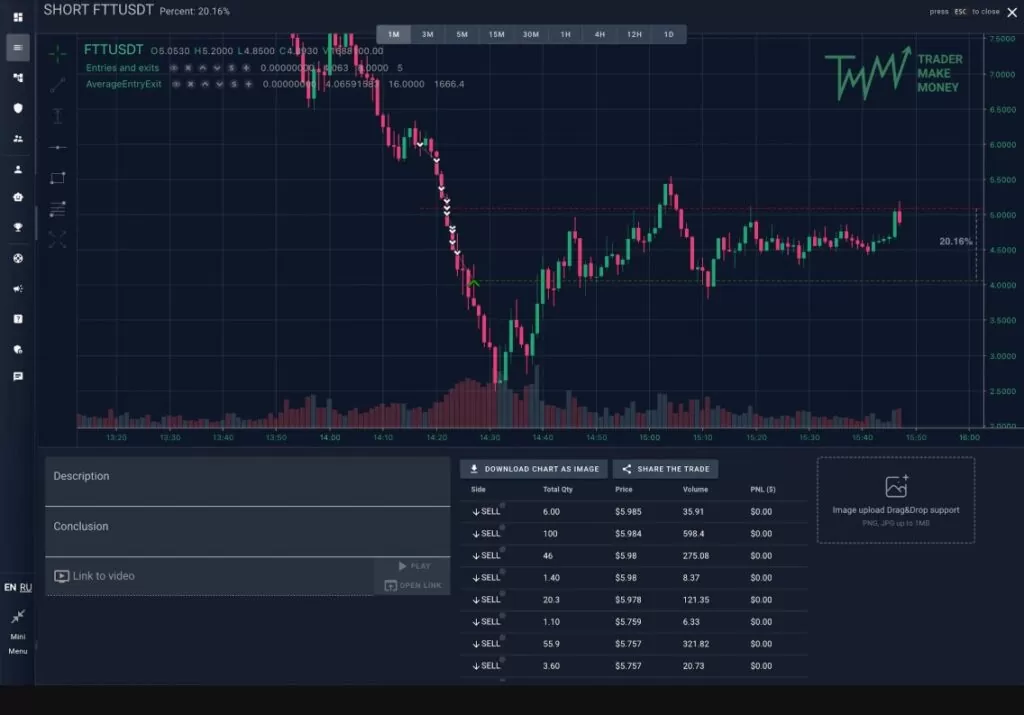

- Refining Your Strategy Reviewing past trades helps you understand which strategies are effective and which ones need to be adjusted or eliminated. This data-driven approach boosts your edge in the market.

- Tracking Progress Just like any business, trading needs performance tracking. Your journal acts like a financial report card, showing your growth, win rate, risk-to-reward ratio, and other key metrics.

- Boosting Confidence Seeing a record of your past successful trades builds confidence and reminds you that you have what it takes to succeed, especially during losing streaks.

Digital vs. Paper Journals

Some traders prefer traditional pen-and-paper journals, while others use digital tools like Excel, Notion, or specialized platforms like TraderSync, Edgewonk, or Tradervue. Choose what works best for your workflow—but the key is consistency.

to find out more about this link

Tips for Maintaining a Powerful Trading Journal

- Be honest. The journal is for your eyes only, so be truthful about your mistakes.

- Update it daily. Don’t let trades pile up. Journal every day for maximum benefit.

- Include screenshots. Visual records of your charts can help you understand price action better.

- Review weekly and monthly. Regular reviews help you stay on track with your trading goals.

Traders who consistently make money treat trading like a business, and every successful business keeps records. A trading journal is not just a record-keeping tool—it’s a mirror that reflects your performance, behavior, and growth. By committing to journaling, you position yourself for smarter decisions, better discipline, and greater profits.

Start your trading journal today—and take a big step toward becoming a consistently profitable trader.

Trading Journal

Read also : ZERO: Commission-Free Trading Account by Gerchik & Co

1 Response

[…] Trader Make Money – The Power of a Trading Journal […]